Visualizing GDP: The Consumer And Uncle Sam To The Rescue

Note

from dshort: The charts in this commentary have been updated to include

the Q3 2012 Advance Estimate.

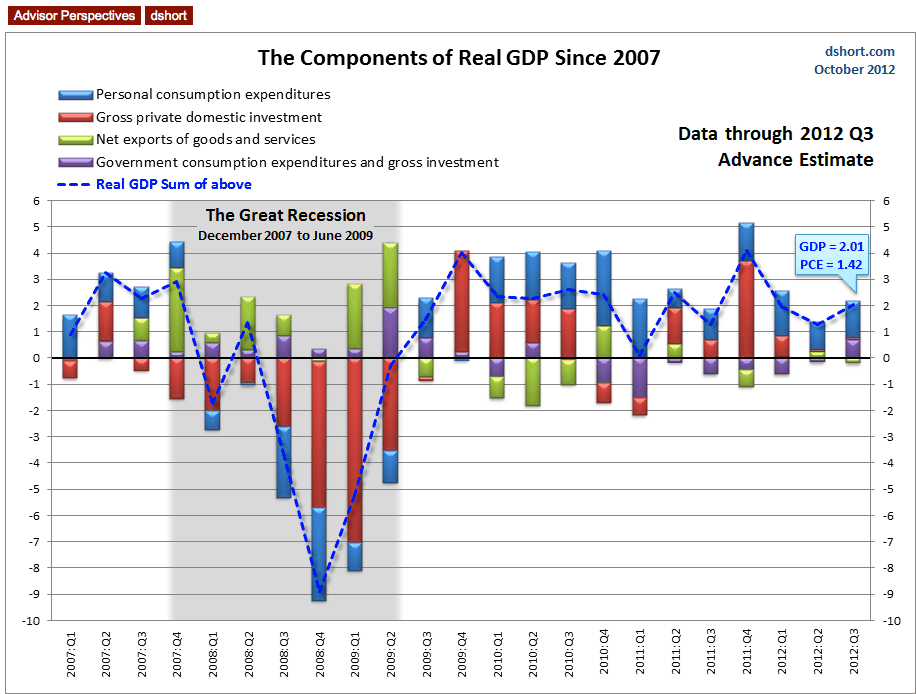

The chart below is my way to visualize real GDP change since 2007. I've used a stacked column chart to segment the four major components of GDP with a dashed line overlay to show the sum of the four, which is real GDP itself. As the analysis clearly shows, personal consumption is key factor in GDP mathematics. The improvement in today's 2.0% Advance Estimate over Q2's 1.3% is largely attributable to a stronger consumer and the federal government's increase in spending.

My data source for this chart is the Excel file accompanying the BEA's latest GDP news release (see the links in the right column). Specifically, I used Table 2: Contributions to Percent Change in Real Gross Domestic Product.

Over the time frame of this chart, the Personal Consumption Expenditures (PCE) component has shown the most consistent correlation with real GDP itself. When PCE has been positive, GDP has been positive, and vice versa. In the latest GDP data, the contribution of PCE came at 1.42 of the real GDP). This is an increase from the 1.06 PCE of the 1.25 GDP in the final estimate for Q1.

Note: The conventional practice is to round GDP to one decimal place, the latest at 2.0. The 2.01 GDP in the chart above is the real GDP calculated to two decimal places based on the BEA chained 2005 dollar data series.

The Long View

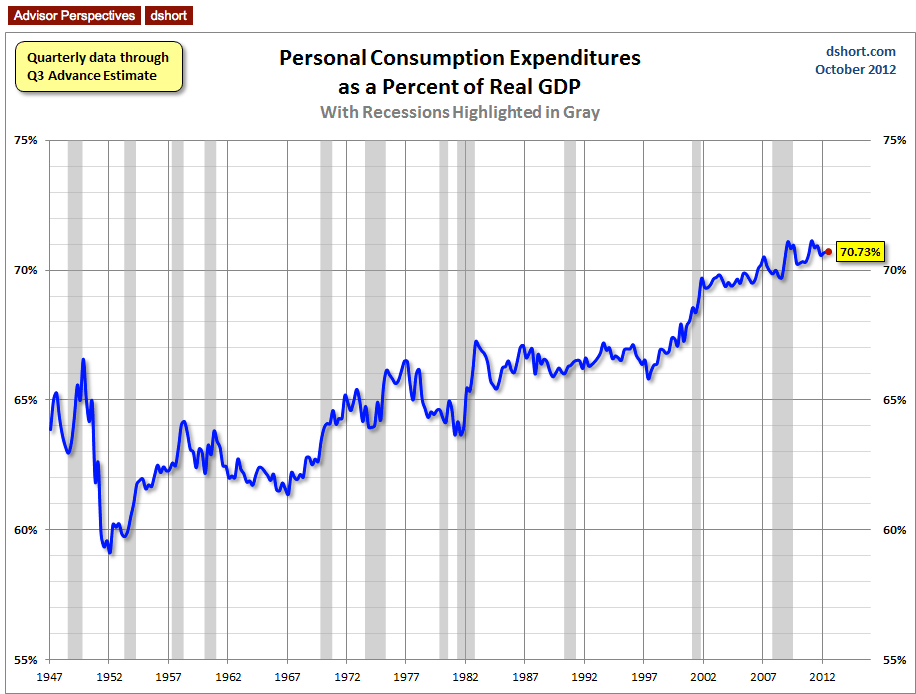

For a long-term view of the role of personal consumption in GDP and how it has increased over time, here is a snapshot of the PCE-to-GDP ratio since the inception of quarterly GDP in 1947. The Q3 2012 ratio is 70.73%, fractionally off the all-time high of 71.15% in Q1 2011.

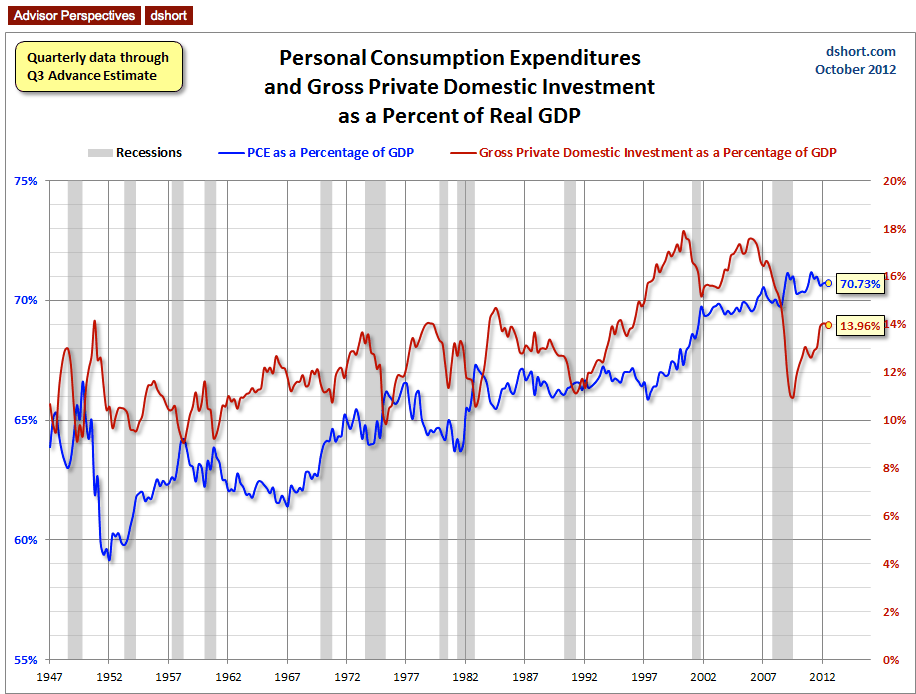

Let's close with a look at the inverse behavior of PCE and Gross Private Investment (GPDI) during recessions. PCE generally increases as a percent of GDP whereas Private Investment declines. I've plotted the two with different vertical axes (PCE on left, GPDI on the right) to highlight the frequent inverse correlation.

I'll update these charts when the Q3 Second Estimate is released next month.

The chart below is my way to visualize real GDP change since 2007. I've used a stacked column chart to segment the four major components of GDP with a dashed line overlay to show the sum of the four, which is real GDP itself. As the analysis clearly shows, personal consumption is key factor in GDP mathematics. The improvement in today's 2.0% Advance Estimate over Q2's 1.3% is largely attributable to a stronger consumer and the federal government's increase in spending.

My data source for this chart is the Excel file accompanying the BEA's latest GDP news release (see the links in the right column). Specifically, I used Table 2: Contributions to Percent Change in Real Gross Domestic Product.

Over the time frame of this chart, the Personal Consumption Expenditures (PCE) component has shown the most consistent correlation with real GDP itself. When PCE has been positive, GDP has been positive, and vice versa. In the latest GDP data, the contribution of PCE came at 1.42 of the real GDP). This is an increase from the 1.06 PCE of the 1.25 GDP in the final estimate for Q1.

Note: The conventional practice is to round GDP to one decimal place, the latest at 2.0. The 2.01 GDP in the chart above is the real GDP calculated to two decimal places based on the BEA chained 2005 dollar data series.

The Long View

For a long-term view of the role of personal consumption in GDP and how it has increased over time, here is a snapshot of the PCE-to-GDP ratio since the inception of quarterly GDP in 1947. The Q3 2012 ratio is 70.73%, fractionally off the all-time high of 71.15% in Q1 2011.

Let's close with a look at the inverse behavior of PCE and Gross Private Investment (GPDI) during recessions. PCE generally increases as a percent of GDP whereas Private Investment declines. I've plotted the two with different vertical axes (PCE on left, GPDI on the right) to highlight the frequent inverse correlation.

I'll update these charts when the Q3 Second Estimate is released next month.

No comments:

Post a Comment