Disclosure: I have no positions in any stocks mentioned, and

no plans to initiate any positions within the next 72 hours.

Some of you may remember watching the 1987 thriller, "Fatal Attraction." In the hit film that featured six Academy Award nominations, Michael Douglas portrays a married man who has a week-end affair with a woman (played by Glenn Close) who refuses to allow the relationship to end. The fling turns into emotional blackmail, stalking and an ensuing obsession on her part. Thanks to the success of the movie, "fatal attraction" has become a household term for love turned to murderous obsession, and the use of the phrase could also be applied to ETF Investing.

Exchange Traded Funds (ETFs) are a simple, relatively inexpensive method of gaining investment exposure to different asset classes or indices. They tend to have low management fees and closely track their benchmarks. An unstated, though fundamental, element to purchasing many of the widely held equity index ETFs: Buying the good, the mediocre and the bad equities. The counteracting factor for owning the universe of stocks in an index is diversification. After all, diversification is a powerful force, reducing portfolio volatility (risk) and allowing an investor to execute simple, passive investment strategies.

ETFs are legion and their investment goals and underlying indices are almost as innumerable. If an investor can conceive of a strategy, there is likely an ETF to implement it. Equity ETFs track everything from nuclear energy to social media to the S&P 500 Index. The ease of buying and selling ETFs allows an investor to build a portfolio emphasizing specific investment strategies. The simplest way to bring a specific exposure to a portfolio is to buy an ETF.

A Fatal Attraction for Financial Advisors

ETFs have many admirers. Their simplicity attracts both retail investors and financial advisors. Retail investors can invest on their own without having to understand the company-specific fundamentals associated with constructing a portfolio. A financial advisor can construct a humble portfolio of a few index ETFs and hold the client's preferred exposure to equity.

ETFs are simple to explain to clients, and they limit the amount of career risk for advisors who can blame the movements of broad indices, not their own stock-picking ability. The portfolio will perform in line with the indices, and the advisor can charge fees in addition to the underlying ETF fees. The ability to mimic the indices, without the risk of deviating far from them, is a boon for financial advisors.

It is worth noting that there is a difference between index underperformance and underperformance from asset allocation. An ETF portfolio can underperform due to misallocation between sectors or asset classes on the part of financial advisors. Since there will typically not be noticeable index underperformance in an ETF portfolio, the chances of the advisor being fired are minimized.

It is a beautiful thing: Gaining market exposure without the risk of significant underperformance, without the necessity to understand company specific fundamentals, and without having to pay for active management. However, these attributes come with caveats.

An ETF does not discriminate between the good, the mediocre, and the bad companies within the index it tracks. This is the reason they are relatively cheap - there is no need to hire a research team to filter the good and bad. An investment manager, by contrast, has the task of understanding industry and company fundamentals to differentiate between equities that will outperform and underperform the broader index.

The manager must have a team trained in current accounting principles, economics, portfolio management, business management, and other professional disciplines. Performance above an index is the single most important task for an active manager. Managers often have a team of analysts, access to third party research, and years of experience to gain conviction on an overweight or underweight relative to the index. An equity index ETF is constrained to the singular objective of mimicking the index, and will not make an investment decision based on a fundamental analysis.

A Fatal Attraction to NEVER outperform

An ETF simply buys the basket of equities in, for instance, the MSCI US REIT Index or the FTSE NAREIT All REITs Index, and rebalances periodically in accordance with the index. This precludes the ability to adjust weightings for qualitative or quantitative characteristics, and this keeps the investment moving in lock step with the underlying index. This seems ideal, but there is a hidden condition to this quality: The ETF will never outperform the index. In fact, because ETFs have embedded fees for the "management" of the fund, they can never even meet the return of the index. Granted, many active managers will underperform their benchmark indices, but it is at least possible to beat their index return.

ETFs are extolled as a way to quickly diversify a portfolio, and therefore reduce volatility. Financial professionals know there are benefits to diversification, but also understand the rewards are not limitless. At a certain point, the volatility reduction becomes minimal and the portfolio begins to lose expected return. This concept is known as the volatility trumpet. Peter Lynch, one of the greatest investors of all time, calls this "di-worse-ification." By purchasing the ETF, an investor has di-worse-ified a portfolio. An active manger can avoid holding the universe of an index, and invest in the companies that are the best in class and provide the greatest return.

Of course, ETFs have their place. For managers of niche strategies, they provide unique ways of gaining exposure to the market or specific sectors in a cost effective manner. ETFs are useful for sophisticated hedging strategies, as the manager can target a specific source of risk in a portfolio. Tradability and liquidity allow for easy entrance and exit for investors seeking short-term market exposure. However, as an unmanaged asset, equity ETFs are not the most effective instrument for long-term wealth creation.

A Fatal Attraction to Skillful Managed Advisors

The investment relationship with ETFs is complicated. The seductive aspects are of the investment, also its problems. Investors are lulled into accepting consistent, slight underperformance, because of a desire to avoid large deviations from index returns. However, there are rewards for selecting a great manager with the desired investment universe, a strong investment process, and a track record of investment success.

A great equity manager employs a research team for a reason: Actively select the stocks that will outperform the index over time, and avoid the stocks that will underperform. By not holding the entire index and concentrating on the stocks with strong fundamentals, active managers can avoid constructing a portfolio that suffers from di-worse-ification. Selecting a manager that best fits an individual's investment strategy requires effort, but the rewards can surpass those of ETFs.

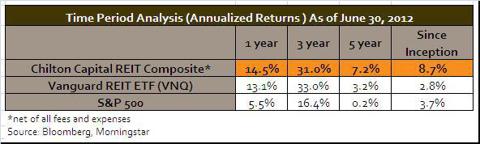

(click to enlarge)

Source: Chilton Capital Management, LLC (*)

A Fatal Attraction to Dividends

So it's not hard to see why investors are attracted to the idea of high-dividend-paying stocks. On the surface, these investments seem to offer the best of both worlds: the potential for long-term capital appreciation and a steady income stream. But this perception rests on a fundamental misunderstanding of how dividends work and specifically the notion that REITs, unlike any other form of security, pays dividends based on a disciplinary law that requires at least 90 percent of their taxable income to be paid to shareholders annually.

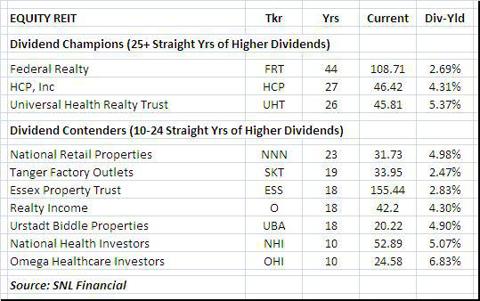

That fatal attraction to dividend stocks can be habit-forming - especially the equity REITs that have maintained consistent and increasing dividends for decades. I am especially attracted to the "dividend champions" that include Federal Realty (FRT), HCP, Inc. (HCP), and Universal Health Realty Trust (UHT), as well as seven "dividend contenders" that include National Retail Properties (NNN), Tanger Factory Outlets (SKT), Essex Property Trust (ESS), Realty Income (O), Urstadt Biddle Properties (UBA), National Health Investors (NHI), and Omega Healthcare (OHI).

(click to enlarge)

Brad Thomas co-wrote this article with Sam Rines, Analyst/Economist with Chilton Capital Management, LLC.

Source: Seeking Alpha contributing writer David Fish produces this US Dividend Champion report on his DRiP Investing Resource Center site.

REIT ETFs include: (VNQ), (ICF), (REZ), (FTY), (RWR), (FRI), (IYR), (KBWY), (WREI), (ROOF), and (REM).

(*) Performance is presented net of fees and expressed in U.S. Dollars. A full list and description of composites is available upon request. Past performance is not a guarantee of future results. This information is presented as a supplement to the fully compliant GIPS presentation of composite performance returns as listed in the CCM presentation materials.

MfranexYtio_mu Ryan Black https://wakelet.com/wake/YQrbOPjJTkHWd9z45C6sH

ReplyDeletecuedigholo

NcunloWscel-chi_Scottsdale Melissa White link

ReplyDeletelink

click here

click here

minvidysno

UcomhaeOfun-yu Haley Johnson Movavi Video Converter

ReplyDeleteWonderShare Recoverit

Adobe Acrobat Pro DC

sahedkiefi

Mvactier-chi Megan Edwardz This is there

ReplyDeleteget

neuturwehrru