What Are Small Caps Telling Us About Risk? (IWM, INDEXRUSSELL:RUT, KBE, OIH, DBA)

share0

Chris Ciovacco: Small

Chris Ciovacco: Small

According to MarketWatch, the Fed may assist in pushing small caps higher:

Supporting momentum from small-cap stocks may come in the form of bank lending incentives from the Fed, according to Michael Jones, chief investment officer of RiverFront Investment Group. Such measures could be announced at the Federal Reserve’s retreat in Jackson Hole, Wyo., later this week or at the September Federal Open Market Committee meeting.

The Euro’s Demise Has Been Set in Motion: Are you protected?

"Nationalism will emerge. Healthier countries will not see fit to spend their hard earned money to bail out their less responsible neighbors."

CLICK HERE to get your Free E-Book, “Why It’s Curtains for the Euro”

The small cap

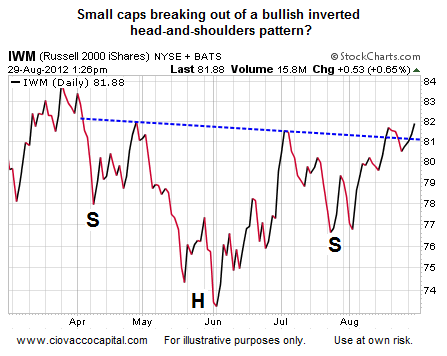

Since the S&P 500 faces strong resistance between 1,403 and 1,415, we have to remain open to false breakouts. Therefore, even if the bullish set-ups outlined in the video below are followed by weakness in small caps, we will still gather useful information about the health of the current rally in stocks, commodities, and precious metals. Key bull/bear levels for the small cap ETF (IWM) are shown at the 00:16 mark of the video. We will monitor these levels in the days ahead to gain a better understanding of the current rally’s sustainability.

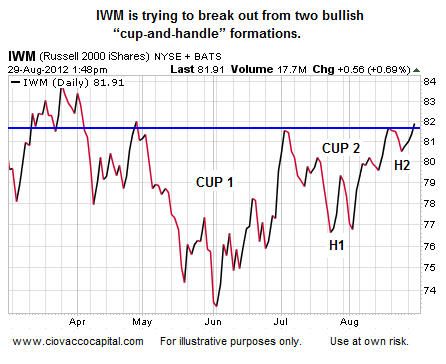

“Stocks were mispriced because people were focused on Greek and Spanish bond yields and less focused on company fundamentals,” Marshall said. “Those kinds of market inefficiencies get exaggerated in the small-cap space.”Another widely utilized pattern by traders is the “cup-with-handle” formation. The handle represents the last wave of selling (or doubt) before a market can move higher. It is possible to see two cup-and-handle formations on the chart of IWM below.

Our respect for the significant overhead resistance facing stocks was a driving force to book profits in the oil services ETF (NYSEARCA:OIH), a position we established back in late June. If small caps (INDEXRUSSELL:RUT), precious metals, and foreign stocks can hold their breakouts, we will turn to our short list of buy candidates, which includes regional banks (NYSEARCA:KBE), small caps (NYSEARCA:IWM), and agricultural commodities (NYSEARCA:DBA).

To feel better about the bullish case, we would like to see the S&P 500 close above 1,415 on a weekly basis. Should conditions deteriorate further, we are happy to raise additional cash. With the Fed and ECB just around the corner, flexibility is more important than ever.

Written By Chris Ciovacco From Ciovacco Capital Management, LLC

Written By Chris Ciovacco From Ciovacco Capital Management, LLCChris Ciovacco began his investment career with Morgan Stanley in Atlanta in 1994. With a focus on global macro investing, Chris uses both fundamental and technical analysis to assist in managing risk while looking for growth opportunities around the globe in all asset classes. If you are looking for an independent money manager or financial advisor, Ciovacco Capital is worth a look. Chris graduated from Georgia Tech with Highest Honors earning a degree in Industrial and Systems Engineering in 1990. His experience in the professional ranks began in 1985 as he began working as a co-op for IBM in Atlanta.

Ciovacco Capital Management, LLC (CCM) is an independent money management firm serving clients nationwide. By utilizing extensive research, disciplined risk management techniques, and a globally diversified approach, CCM prudently manages investments for individuals and businessowners. Our focus is on principal protection and purchasing power preservation in an ever-changing global investment climate.

No comments:

Post a Comment